New policies on automobile import in Vietnam

From 01/01/2018, a series of tax policies, fees, inspections, traffic laws are effective, affecting the price of cars as well as plans to import cars and componentsof enterprises into Vietnam. The outstanding regulations on cars effective from 2018 individuals, businesses operating in this field should know.

Import tax from ASEAN to 0%

As committed in the ASEAN Free Trade Area (ATIGA), cars with a localization rate of 40% or more will be entitled to zero import tariffs. From 2018, Vietnam imported cars from Thailand, Indonesia, Malaysia ... with 0% tax, a deep reduction with tariffs in 2017 is 30%.

Cars want to be discounted as such, must meet the two criteria, produced by an ASEAN country and the localization rate of 40%. Cars are imported from ASEAN but the domestic rate is lower than 40% or car imported from a foreign country such as Korea, Japan, Europe ... also do not enjoy this incentive.

Import Tax of components to 0%

According to the Decree No. 125/2017, domestic assemblers will enjoy a zero component import tax rate if the stipulated output is reached, applied to cars under 9 seats. This Decree applies to about 30 sets of main components, customs code from 98.49.11 to 98.49.40.

In the first period, in the first half of 2018, car manufacturers (less than 9 seats, engines 2.5 and below) who would like to enjoy the zero percent import tax incentives ensure two conditions: general output from 8.000 units or more and a car model with a commitment of 3,000 units or more.

Imported cars are difficult to return to Vietnam because of lack of documents

Decree No. 116/2017 stipulates that enterprises wishing to import cars must have a type approval certificate issued by a foreign organization. Most joint ventures believe that foreigners do not issue this type of paper for imported vehicles, only for domestic vehicles, so the company will not be able to import cars.

For example, VAMA has submitted 4 recommendations to the Prime Minister for adjustments to help companies easily import cars but so far nothing has changed. Companies such as Toyota, Honda, and Ford say the car can only be sold to the New Year, and then not know if there are cars or not.

Increasing in tax of import old cars

According to the Decree No. 125/2017 issued by the Government on November 16, 1977, the absolute tax rate applies to vehicles with engine displacements not exceeding one liter and mixed taxes per vehicle per liter.

In the old calculation, the car was divided into four categories according to engine volume with different tax rates. In the new calculation, the car is divided into two types of engine from one liter downwards and per liter. Vehicles of one liter or less are subject to an absolute tax of $ 10,000, while vehicles per liter apply a flat tax rate.

In the segment of cars under 1 liter, mainly models of small urban car, the price of imported cars more than doubled than the current. With larger motorized vehicles, import tariffs may increase by several tens to hundreds of thousands of dollars, depending on the engine capacity and the value of the vehicle.

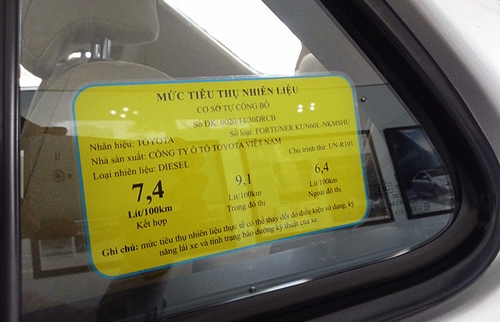

Small cars must be labeled with energy

From 1/1/2018, cars from over 7 seats to 9 seats are produced, assembled from spare parts, completely new; Unused import vehicles must be labeled with energy before being put on the market.

This Circular is not compulsory for the following cases: Vehicles manufactured, assembled or imported for direct use for defense or security purposes by the Ministry of Defense or the Ministry of Public Security; vehicles temporarily imported for re-export; Transit vehicles; vehicles of diplomatic or consular; Imported single-car and non-commercial vehicles; imported vehicles according to separate regulations of the Prime Minister; Vehicles used are non-petrol, diesel, liquefied petroleum gas (LPG), natural gas (NG).

Cars are under standard of level 4 emission are not registered

According to Official Letter No 436/2017 of the Prime Minister stipulating the roadmap for the application of emission standards for automobiles, assemblers and importers, from January 1, 2015, the authorities will not do Registration procedures for vehicles that do not meet level 4 emissions standards.

The vehicle has been certified by the Ministry of Transport to meet the new exhaust emission regulations to carry out the relevant procedures. Before that, enterprises must have plans to import and produce automobiles, ensure the fulfillment of customs procedures, register them and market them before December 31, 2017. After this time, if not completed must be re-exported or exported.